Pig Butchering Scam Warning Signs: The Subtle Red Flags Victims Miss Early

One of the most dangerous aspects of the pig butchering scam is that the warning signs rarely appear obvious at the beginning. Unlike phishing or fake airdrops, this scam is carefully engineered to feel natural, supportive, and unthreatening. Many victims later say the same thing: “Nothing felt wrong at first.”

This article breaks down the early red flags of pig butchering scams — the signals that often go unnoticed until significant emotional and financial damage has already occurred.

Why Early Warning Signs Are Hard to Spot

Pig butchering scams are designed to avoid classic scam behavior. There is:

- No urgency at the start

- No immediate money request

- No obvious technical trick

Instead, the scammer focuses on building comfort and routine, which lowers skepticism over time.

Early Red Flag #1: Conversations That Feel “Accidentally Perfect”

Many pig butchering scams begin with:

- A wrong-number message that turns friendly

- A chance social media interaction

- A dating app match who feels unusually compatible

The conversation flows easily, interests align quickly, and rapport builds faster than expected. This is often intentional — scammers follow scripts designed to accelerate emotional connection.

Early Red Flag #2: Consistent, Predictable Communication

Healthy relationships fluctuate. Pig butchering scams do not.

Scammers often:

- Message at the same times every day

- Maintain constant availability

- Respond quickly and consistently

- Rarely miss a day of communication

This consistency creates emotional dependency and routine, making later manipulation easier.

Early Red Flag #3: Gradual Personal Disclosure Without Vulnerability

Scammers share personal stories, but they are carefully controlled:

- Success stories without setbacks

- Past struggles that conveniently lead to wealth

- Claims of discipline, intelligence, or insider knowledge

What’s missing is real vulnerability. The stories are designed to impress, not reveal.

Early Red Flag #4: Investment Talk That Feels Casual, Not Salesy

Unlike traditional scams, pig butchering introduces investing subtly:

- “I’ve been trading for years”

- “It’s just something I do on the side”

- “I wouldn’t normally share this”

The lack of pressure makes the advice feel trustworthy — like a favor, not a pitch.

Early Red Flag #5: Success Without Visible Risk

When investing is mentioned, it often sounds:

- Predictable

- Calm

- Controlled

- Low stress

Real trading involves uncertainty, losses, and emotional swings. When someone presents investing as consistently smooth, it’s often a fabrication.

Early Red Flag #6: Encouragement to Keep Things Private

As trust grows, scammers may suggest:

- Not involving friends or family

- Keeping the opportunity “between us”

- Avoiding outside opinions

This isolates the victim and removes external reality checks before money is ever discussed seriously.

Early Red Flag #7: Platforms That Appear Only After Trust Is Built

The investment platform is rarely introduced early. When it does appear:

- It’s framed as exclusive

- It’s not widely discussed publicly

- It’s accessed through direct links

- It looks professional but unfamiliar

By this stage, emotional trust often overrides technical skepticism.

Why Victims Rationalize These Red Flags

Victims often explain away concerns because:

- The relationship feels real

- The scammer has invested time and attention

- Early interactions involved no money

- Small successes reinforce belief

This creates a psychological trap where doubts feel disloyal or irrational.

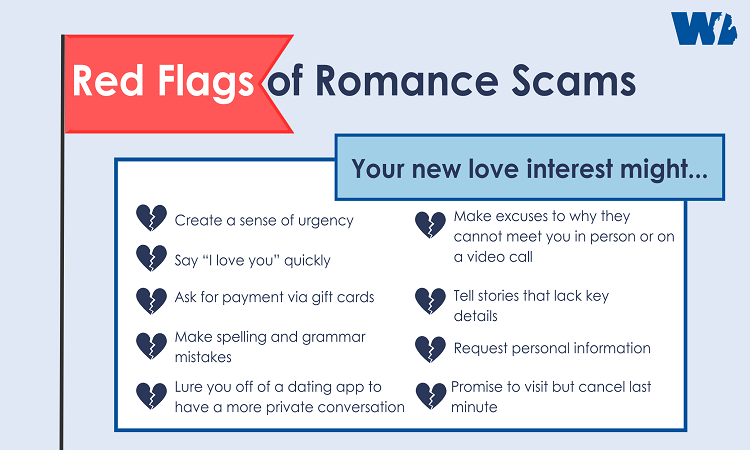

How Pig Butchering Differs from Fast Scams

- Fast scams rely on urgency

- Pig butchering relies on patience

- Fast scams pressure

- Pig butchering reassures

- Fast scams trigger fear

- Pig butchering builds comfort

This difference is why even cautious people fall victim.

Who Is Most Likely to Miss Early Signs

Early red flags are most often missed by:

- Professionals with busy routines

- People new to crypto investing

- Individuals experiencing loneliness or change

- Users who value relationship-based trust

Emotional context matters more than technical knowledge.

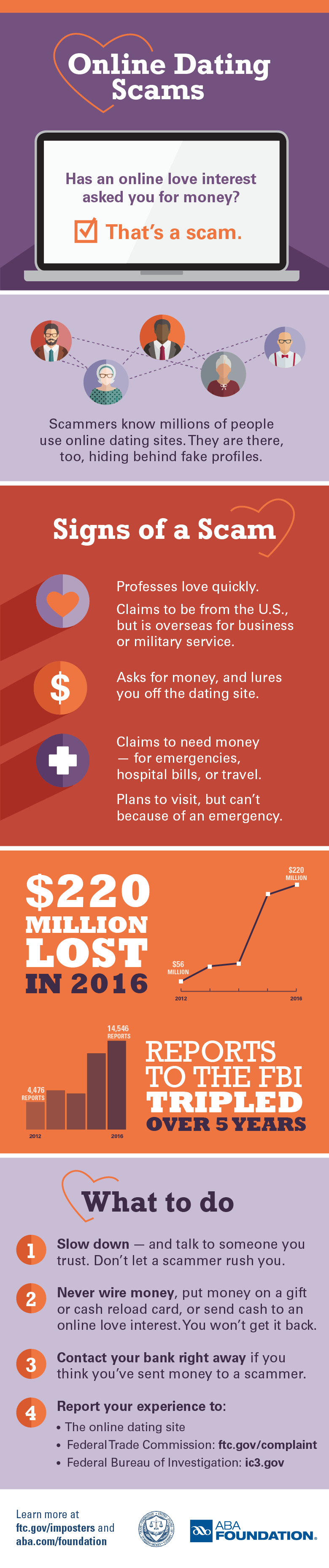

What to Do If These Signs Feel Familiar

If parts of this pattern feel familiar:

- Pause before any financial action

- Avoid sending funds or credentials

- Seek a neutral outside perspective

- Be cautious of platforms introduced privately

Early hesitation can prevent long-term damage.

Final Thoughts

Pig butchering scams succeed because they don’t feel like scams at first. The early warning signs are emotional and behavioral, not technical. By the time financial red flags appear, trust has already been carefully engineered.

Recognizing these subtle signals early is one of the most effective ways to avoid becoming a victim. In long-term crypto scams, the danger often isn’t a single moment — it’s the slow erosion of skepticism over time.