Fake Liquidity Mining Scam Explained: How “Yield Farming” Is Used to Drain Crypto

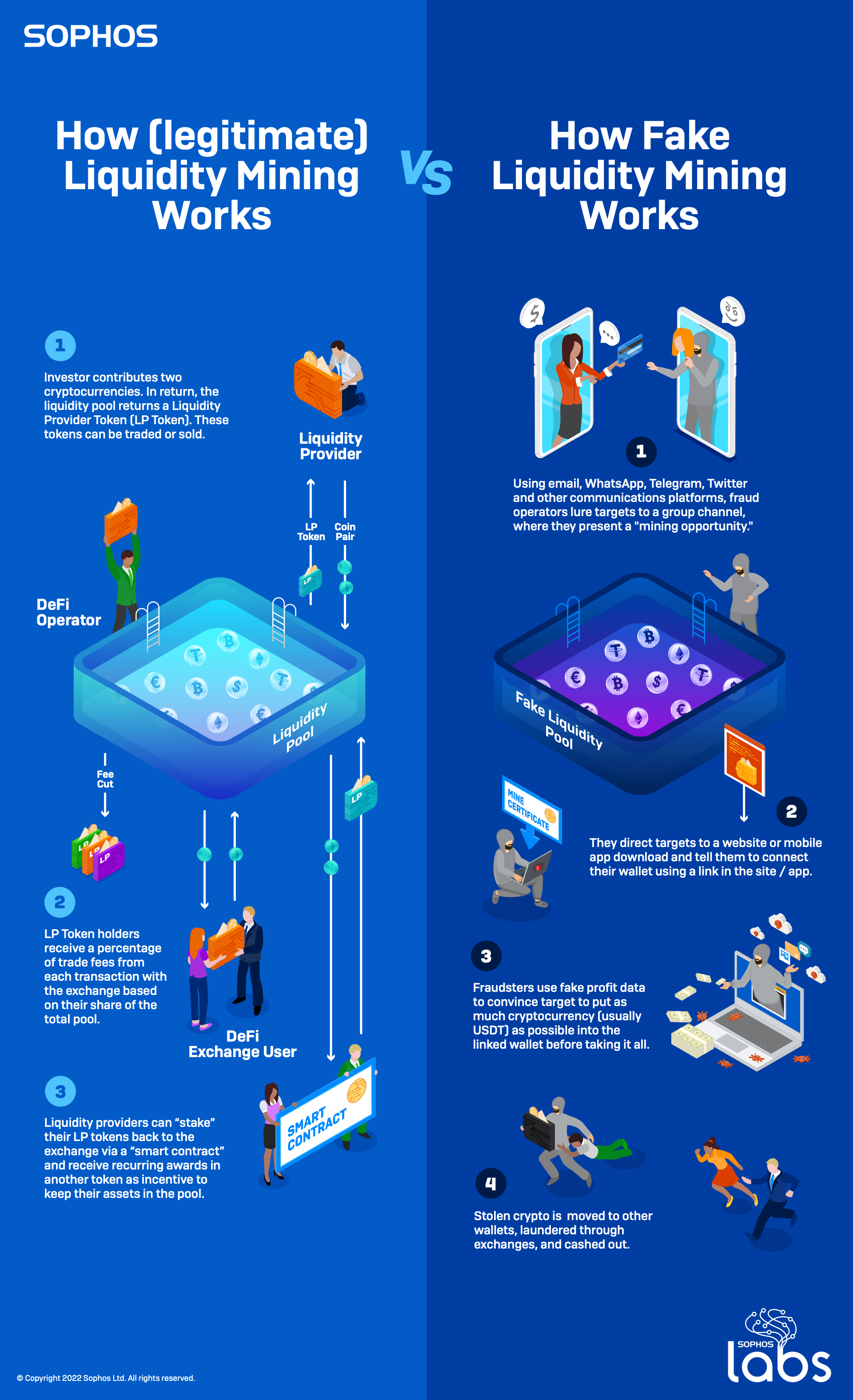

The fake liquidity mining scam (often disguised as yield farming) is a DeFi-themed fraud where users are promised high returns for providing liquidity to a pool that does not actually exist. Victims see balances grow on a dashboard, but the underlying smart contracts or pools are either malicious or completely fake.

This scam blends technical language with impressive visuals, making it especially convincing to users who are familiar with DeFi concepts but don’t verify on-chain activity.

What Is a Fake Liquidity Mining Scam?

A fake liquidity mining scam occurs when a platform claims users can:

- Deposit crypto into a liquidity pool

- Earn rewards or yield over time

- Withdraw both principal and rewards later

In reality:

- The pool is not real, or

- The smart contract is designed to block withdrawals, or

- Deposits are immediately routed to scammer wallets

The “mining” or “farming” exists only on the dashboard.

How the Fake Liquidity Mining Scam Works

Step 1: DeFi-Themed Promotion

Victims are introduced to:

- A new liquidity pool

- A high-APR farming opportunity

- A “limited-time” yield event

The language sounds legitimate and mirrors real DeFi protocols.

Step 2: Deposit to “Provide Liquidity”

Users deposit crypto to:

- Activate mining

- Start earning yield

- Unlock higher reward tiers

The deposit transaction may look normal, which builds trust.

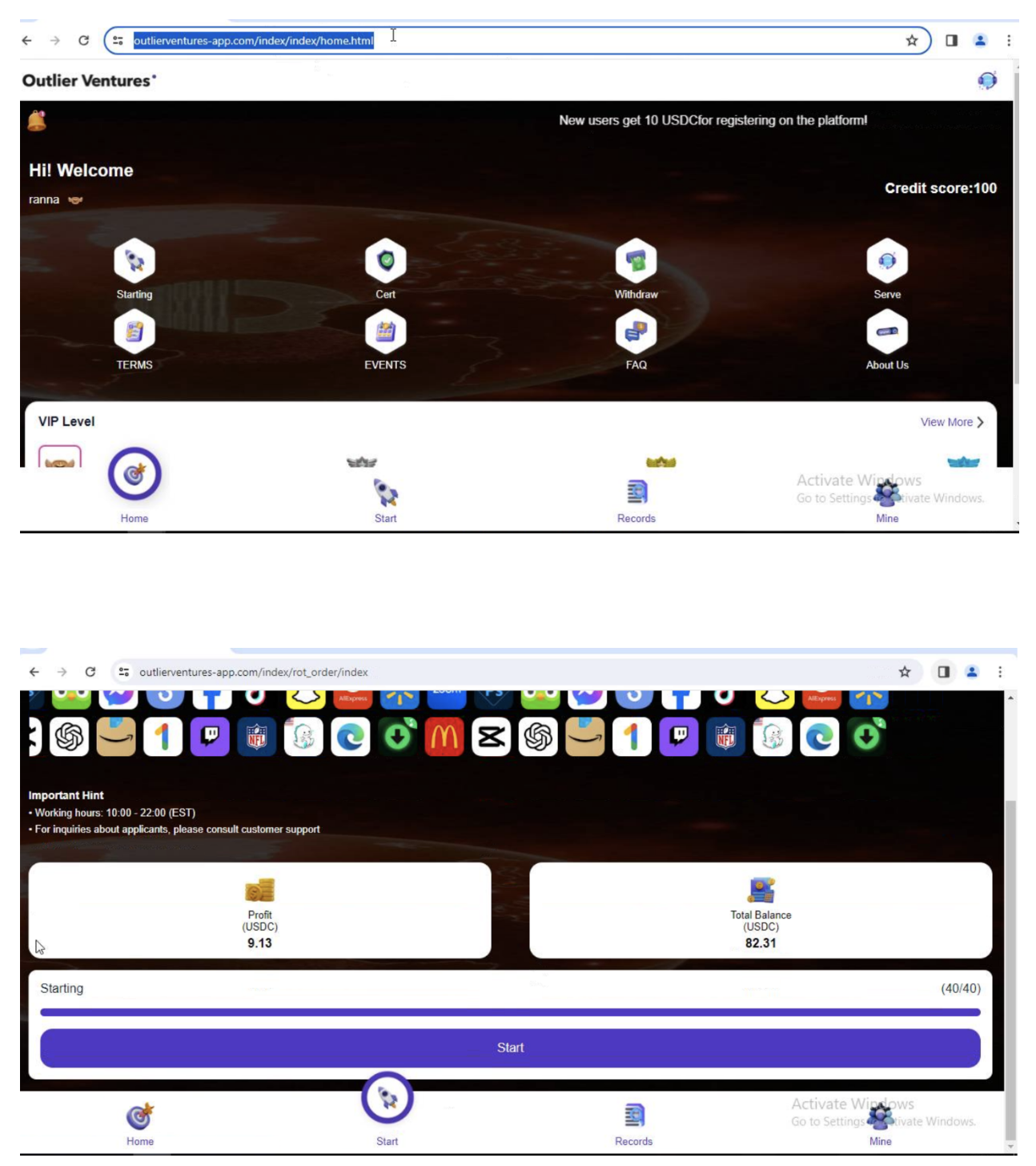

Step 3: Dashboard Rewards Appear

Soon after:

- Rewards begin “accruing”

- APY looks impressive

- Balances increase steadily

These numbers are often simulated, not earned.

Step 4: Withdrawal Is Blocked

When users attempt to withdraw, they are told:

- Liquidity is locked

- Pool conditions must be met

- Fees or taxes are required

- Additional deposits are needed

None of these conditions were disclosed upfront.

Step 5: Escalation or Exit

After repeated payments:

- Withdrawals still fail

- Support becomes evasive

- The platform disappears or freezes accounts

The liquidity was never real.

Why Fake Liquidity Mining Is So Convincing

This scam works because:

- Liquidity mining is a real DeFi concept

- Users expect smart contracts and lockups

- Dashboards look technical and professional

- Yield numbers distract from verification

- Victims assume complexity equals legitimacy

The scam hides behind real terminology.

Common Variations of the Scam

“Exclusive Pool” Scam

Users are told the pool is private or invite-only, discouraging public verification.

“Liquidity Lock” Excuse

Funds are claimed to be locked for stability or security reasons.

“Gas or Unlock Fee” Scam

Victims must pay extra to withdraw mined rewards.

“Pool Upgrade” Delay

Withdrawals are blocked due to a supposed contract upgrade.

Each variation leads to the same result: no withdrawal.

Key Red Flags to Watch For

- No verifiable on-chain liquidity pool

- Rewards appearing too quickly

- APRs far above market norms

- Withdrawal rules introduced after deposit

- Requests for extra payments before withdrawal

- No independent proof of pool existence

Real liquidity pools are publicly verifiable.

Fake Liquidity Mining vs Real DeFi Farming

Real DeFi farming:

- Pools are visible on-chain

- Smart contracts are public

- Liquidity amounts can be verified

- Withdrawal rules are known upfront

Fake liquidity mining:

- Exists only on dashboards

- Uses vague or hidden contracts

- Introduces new rules constantly

- Requires repeated payments

Transparency is the difference.

Who Is Most Targeted

Fake liquidity mining scams often target:

- DeFi users seeking yield

- Crypto investors chasing passive income

- Users familiar with farming concepts

- Victims of earlier crypto scams

- Users contacted through private channels

Knowledge of DeFi can increase confidence—and risk.

What To Do If You’re Facing a “Liquidity Mining” Issue

If a platform claims your liquidity is locked:

- Do not pay unlock or gas fees

- Stop depositing additional funds

- Preserve transaction records and screenshots

- Be cautious of promises tied to more payments

Repeated conditions are a major warning sign.

Final Thoughts

Fake liquidity mining scams exploit the popularity of DeFi by copying its language without its transparency. The promise of yield distracts from a simple truth: if you can’t verify the pool on-chain, it likely doesn’t exist.

In DeFi, visibility is protection.

If liquidity can’t be seen, measured, and withdrawn under clear rules, it isn’t liquidity—it’s a trap.